72% of shoppers say transparency matters. Here's what grocers can do.

FMI found that shoppers who spend more and consumers who shop online are more likely to key in on transparency. However, grocers have room to improve transparency online, the trade group noted.

FMI also spotlighted how shoppers are looking beyond labels for information, suggesting grocers can pursue digital or alternative avenues to provide more details.

The report's findings are based on a "nationally representative sample of [1,035] U.S. grocery shoppers based on age, gender, region, race, ethnicity, income and household composition" from Sept. 14-28 and more than a dozen interviews with shoppers.

Consumer demand for more information stems from several areas, with interest ranging from health and well-being (78%) to wanting to buy more eco-friendly products (69%) to seeking more information generally about what they are buying (78%), FMI noted.

Certain demographic segments, like people who live in urban areas, are more likely to search labels to see if a product meets their diet or health needs. When looking into improving transparency, grocers may want to start first by analyzing their customer demographics and target shoppers, FMI noted. Not surprisingly, the trade group said younger consumers are generally more interested in looking beyond labels for information.

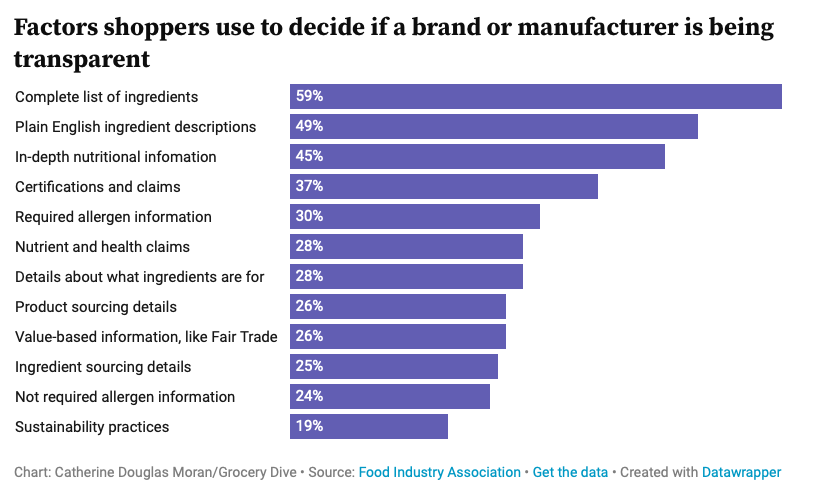

Factors shoppers use to decide if a brand or manufacturer is being transparent

Seventy-seven percent of shoppers said they would consider seeking information online, indicating retailers could explore ways to give more detailed information through their apps and websites or with third-party partners.

But FMI found some obstacles online. Seventy-four percent of surveyed shoppers said it’s challenging to find products that meet their needs when shopping online, compared to 63% who said the same for in-store shopping.

Even basic nutrition and ingredients information, which companies aren't required to list online, can be hard to track down. A recent analysis by researchers from the NYU School of Global Public Health and the Friedman School of Nutrition Science and Policy at Tufts University found that the nutrition information and ingredients lists the FDA requires on physical packaging appeared on only 36.5% of online products the researchers viewed across nine grocery retailers.

A number of retailers, including Walmart and Target, have added new ways for customers to discover products online and in-store that align with specific attributes. Some, like The Giant Company and Hy-Vee, are using QR codes to enhance discovery and provide shoppers with more product information.

Retailers who don't focus on transparency, especially with their private label, could see shoppers turn to other offerings. When confused by a product’s label, 55% of surveyed consumers said they would look at other products, the report found. In a testament to how important transparency is, 64% of surveyed shoppers said they would switch from a brand they usually buy to another one with more detailed information beyond what is on the physical label.